what is hospital indemnity insurance worth it

Overall however Id say that hospital indemnity insurance is not worth it. Similar to accident insurance it is a supplemental option to your primary health coverage.

Is Hospital Indemnity Insurance Worth It Glg America

Basically Im in good health and almost never see the inside of a hospital despite working in healthcare IT.

. Hospital indemnity insurance is coverage you can add to your existing health insurance plan. Depending on the plan. Moreover the cost is not significantly great.

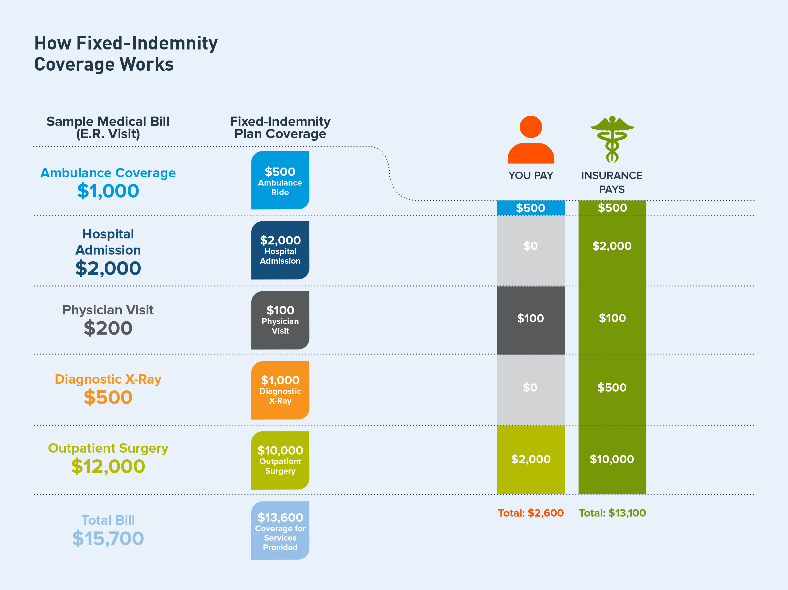

4 While health insurance pays for medical services after copays co-insurance and deductibles are met hospital indemnity insurance pays you if you are hospitalized. And in this example the monthly premium for Jane is only 3146. This type of coverage pays you direct cash if you have to go to the hospital.

This form of supplemental insurance pays you a predetermined benefit amount per day for each hospital confinement. That makes things a lot easier. Generally most hospital indemnity insurance plans allow you to receive 100 to 600 a day according to Necole Gibbs a licensed broker at the TNG Insurance Agency in Georgia.

What Is Hospital Indemnity Insurance. When the unexpected happens a trip to the hospital may be a possibility. With hospital indemnity insurance you only get the benefits paid if you have a stay in the hospital.

Not only is Janes hospital bill almost completely paid for but it came at an affordable price. Hospital indemnity insurance is another supplemental insurance used to prepare for the cost of labor and delivery. Hospital indemnity insurance supplements your existing health insurance coverage by helping pay expenses for hospital stays.

Also known as hospital confinement indemnity insurance or simply hospital insurance it is considered a type of supplemental insurance. Hospital indemnity insurance is a type of supplemental coverage that pays benefits if youre hospitalized. Not only are you not getting much bang for your buck you are also pigeonholed into a specific situation.

More efficient modern healthcare and outpatient procedures. We feel that hospital indemnity insurance is worth the money. On average new mothers spend 1-4 days in the hospital after giving birth with average out-of-pocket expenses for childbirth exceeding 3400.

What does an indemnity plan cover. Your priority should always be to. Depending on the policy coverage ranges from the mothers admission to the hospital for a normal labor and delivery to an ill infants stay in a neonatal intensive care unit.

Data from the Centers for Disease Control and Prevention found that only 12 of emergency room visits resulted in hospital admission. That means while Jane has to pay the hospital 1160 in copays her hospital indemnity policy is going to send her a check for 1100. You may also hear it referred to as hospital confinement indemnity insurance.

In fact hospital indemnity insurance is a waste of your hard-earned money. Why Get Hospital Indemnity Insurance. Hospital indemnity insurance also known as hospital confinement insurance or simply hospital insurance is supplemental medical insurance coverage that pays benefits if you are hospitalized.

Its not meant to replace your existing health insurance but rather act as a safety net in the event of an emergency or needed hospital stayprocedure. Indemnity plans allow you to direct your own health care and visit almost any doctor or hospital you like. That means its designed to complement traditional health insurance.

The insurance company then pays a set. 1 an in-patient situation such as an illness or severe injury. But is hospital indemnity insurance worth it.

In lieu of accident insurance another option you can consider is hospital indemnity. Hospital indemnity insurance helps by putting recovery first over hospital bills. The plan covers employees who are admitted to a hospital or ICU for a covered sickness or injury.

Hospital indemnity insurance is a supplemental insurance plan designed to pay for the costs of a hospital admission that may not be covered by other insurance. Additionally you can simply save the deductible and the out of pocket maximum on your plan. Hospital indemnity insurance can.

The insurance company usually pays this daily benefit amount for up to a year. 1 If you dont go to the hospital your benefits wont get paid to you. Find out what hospital indemnity covers if its worth and its advantages in this article.

Hospital indemnity insurance can help ease your stress about hospital bills so you can focus more on getting better. When it comes to the health of you and your family unexpected or long-term hospitalizations should not be a time to worry about medical costs. If you spend extra money on hospital indemnity insurance at all it should only be after you have three-to-six months of your expenses saved away in an emergency fund.

Hospital indemnity insurance is a type of policy that helps cover the costs of hospital admission that may not be covered by other insurance. In our opinion it is a safety net preventing you from experiencing potentially high out-of-pocket costs with your health care. Essentially hospital indemnity insurance can help provide protection or assistance with expensive bills that can add up after a visit to the hospital.

One of the benefits is Hospital Indemnity Insurance which as I understand it basically means that you will get a direct payout payout when you are hospitalized. Hospital Indemnity Insurance is a policy that will pay you directly for going to the hospital for any reason really including but not limited to. In addition hospital indemnity insurance is excellent for expecting mothers.

The answer to that question is that hospital indemnity insurance is that it is not worth it. Despite that this plan seems ludicrously lenient heres the math. Is Indemnity Insurance a Replacement for Health Insurance.

And its available for companies with as few as two employees. Ideally hospital indemnity insurance comes as a supplement to existing insurance. This is why we think hospital indemnity insurance is worth the money.

Wondering whether Hospital Health Insurance is worth getting. The Limitations of Hospital Indemnity Plans. Hospital Indemnity Insurance is a simple supplemental health insurance policy that pays a set dollar amount for.

The first issue with hospital indemnity plans is that they only pay benefits if the employee is hospitalized.

It S Common For Business Owners To Think That Professional Indemnity Insurance Is Something Only Professional Indemnity Insurance Indemnity Insurance Indemnity

Hospital Indemnity Insurance The Hartford

What Is Hospital Indemnity Insurance And Do I Need It American Income Life Insurance Co

Hospital Confinement Indemnity Insurance Plans Indemnity Insurance Skilled Nursing Facility Indemnity

Why Group Hospital Indemnity Ppt Download

Sun Life Offers Hospital Indemnity Insurance With New Extended Hospitalization Coverage To Help Members Close Coverage Gaps Sun Life

4 Facts You Need To Know About Hospital Indemnity Insurance

It S Important For Small Business Owners To Remember That The Costs Associated With Providing Health Insurance Employee Health Business Owner Health Insurance

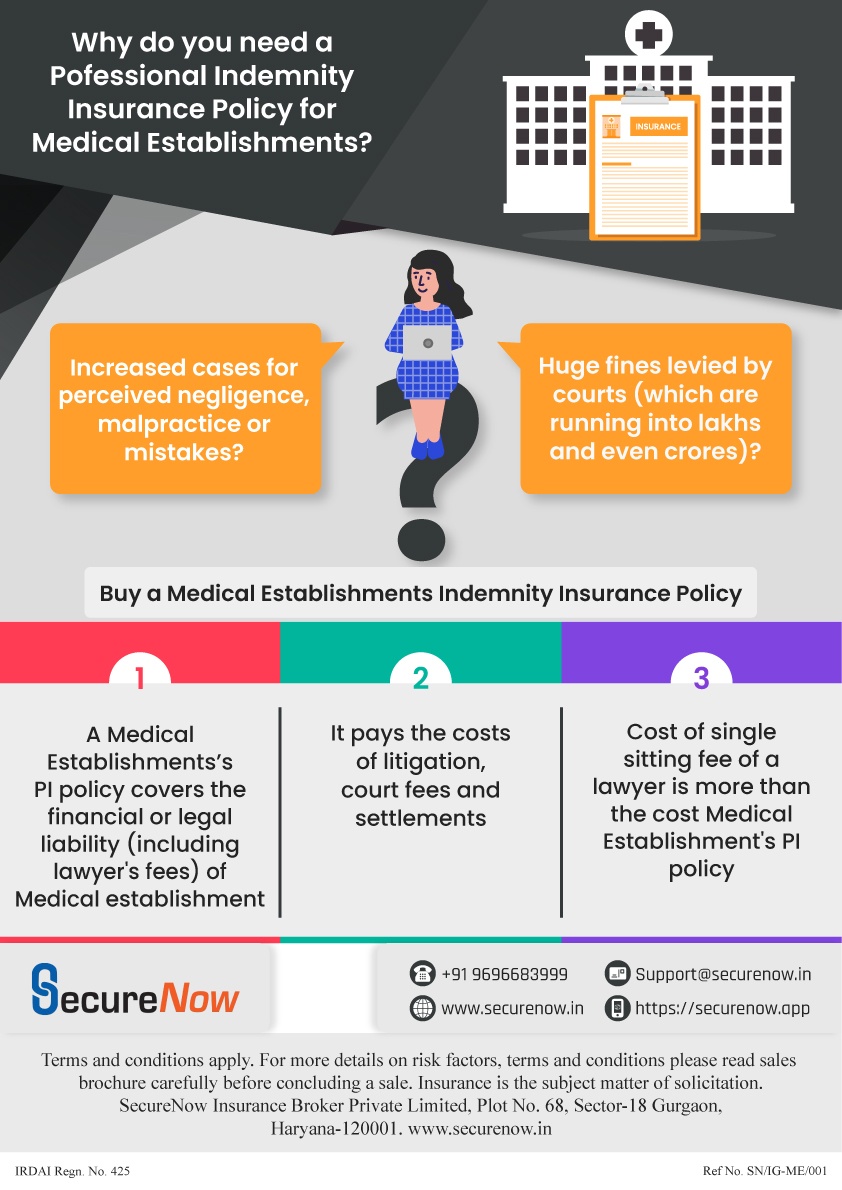

Why Should Doctors Buy Professional Indemnity Insurance Securenow

Dangers Of Fixed Indemnity Plans But Not In The Eyes Of The Court Triage Cancer Finances Work Insurance

You Put A Lot Of Planning Into Your Wedding Day But You Have Considered The Must Do S Once You Say I Do He Life Insurance Marketing Ideas Newlyweds Financial

Hospital Indemnity Insurance What You Need To Know

Dangers Of Fixed Indemnity Plans But Not In The Eyes Of The Court Triage Cancer Finances Work Insurance

Importance Of Doctors Professional Indemnity Policy Infographic Securenow

Importance Of Professional Indemnity Policy For Medical Establishments Infographic Securenow

It S A Brand New Week Have You Reviewed Your Life Insurance Beneficiaries Recently If Not Let S Chat In 2022 Life Insurance Beneficiary Life Insurance Life Plan

4 Facts You Need To Know About Hospital Indemnity Insurance

File A Hospital Indemnity Insurance Claim American Fidelity

Indemnity Health Insurance Plans Allow You To Choose The Doctor Healthcare Professional Hospital Or Servi Health Insurance Plans Health Insurance How To Plan