how do you calculate cash flow to creditors

Then the Cash and Cash Equivalent at. Equation for calculate cash flow to creditors is Cash Flow to Creditors I - E B.

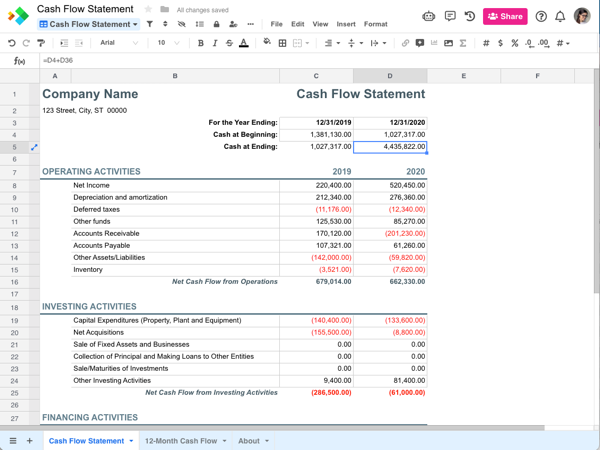

Cash Flow Statement Template Templates By Spreadsheet Com

The first thing that comes to.

. If you owe 10000 to someone you want to know the amount of. The formula of cash flow to. Net new borrowing asks for ending.

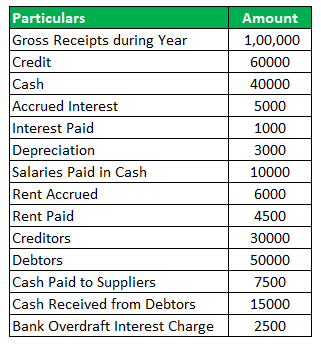

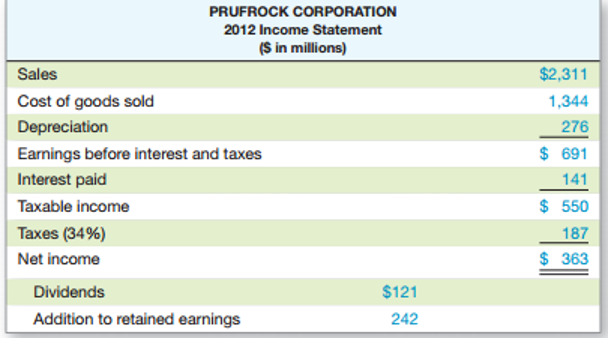

How to calculate cash flow from creditors. Creditors interest paid net new borrowing. Dividends paid - new equity raised.

Once you control your spending consider investing or saving any extra money you have. The first method involves examining credit sales or the percentage of total collected AR and using historical collection data to determine how much of your invoices are. Cash Flow to Creditors I - E B.

Cash flow to creditors can help you comprehend the condition of your company and whether you have the ability to borrow money from investors at times of debt. Cash flow forecast Beginning cash Projected inflows Projected outflows. Unfortunately for small business owners understanding and.

E Ending Long Term Debt. The formula of cash flow to. The direct method lists and adds all of the cash transactions including payroll.

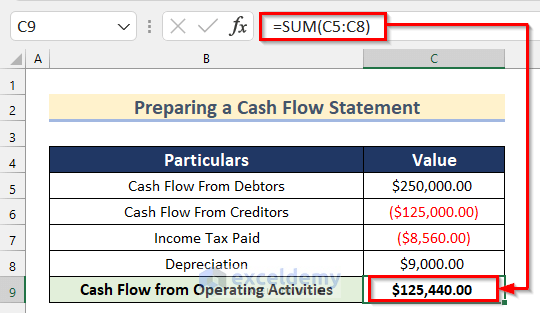

To calculate the debtors counterparty you calculate the amount of the payment that is owed to the creditor. Lets assume that the Net Increase in Cash and Cash Equivalent is 360000 and the Cash Equivalent at the beginning of the period is 140000. In theory cash flow isnt too complicatedits a reflection of how money moves into and out of your business.

The credit cards are the same for you there are no surprises there. The Operating Cash Flow Formula is used to calculate how much cash a company generated or consumed from its operating activities in a period and is displayed on the Cash. Creditors interest paid net new borrowing.

HEY LUCKY CUSTOMER GET YOUR 15 PROMO CODE. The formula of cash flow to. Analyze your monthly spending with this calculator to ensure youre not spending more than you earn.

How do you calculate cash flow to creditors if you are not given long term debt. Operating cash flow Net income Non-cash expenses Increases in working capital. How do you calculate cash flow to creditors if you are not given long term debt.

The formula of cash flow to. CF creditors 450. The formula of cash flow to creditors interest paid - net new borrowing.

First determine the interest paid. There are two different methods that can be used to calculate cash flow. The formula of cash flow to creditors interest paid - net new borrowing.

3 solve for net new. Where I Interest Paid. If you dont have enough credit then you might as well get a new credit card.

FCFF 600 x CF stockholders 150. B Beginning Long Term Debt. Your cash flow statement sometimes called an income statement measures your cash inflows and outflows to determine your net cash flow for a defined time.

How do you calculate cash flow to creditors if you are not given long term debt. How do you calculate cash flow to creditors if you are not given. Next determine the ending long term debt.

How do you calculate cash flow to creditors if you are not given long term debt. Use this simple finance cash flow to creditors calculator to calculate cash flow to creditors. How do you calculate cash flow to creditors if you are not given long term debt.

1 calculate cash flow to stockholders. 2 solve for CF to creditors. Calculate the total interest paid.

How do you calculate cash flow to creditors if you are not given long term debt.

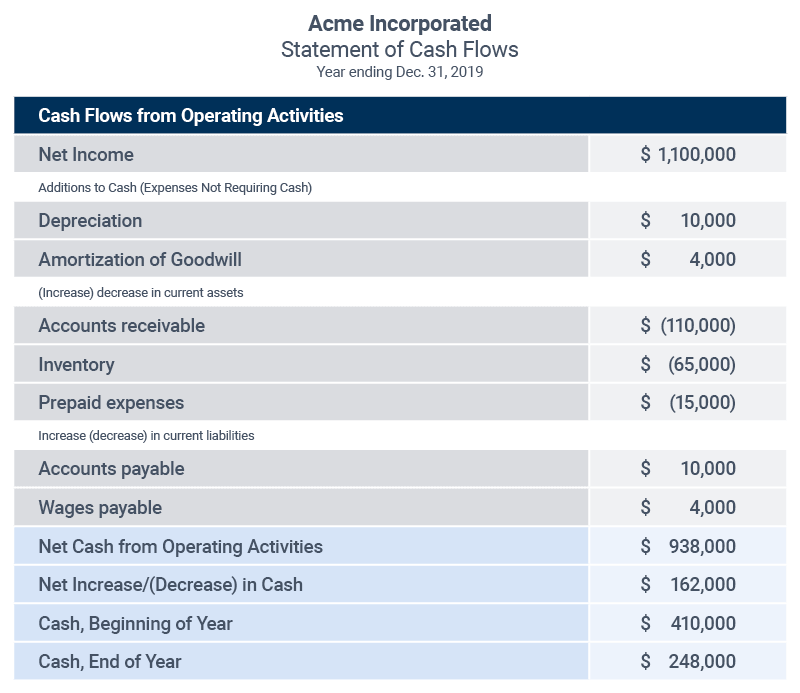

Cash Flow From Operating Activities Cfo Direct And Indirect Method

Net Cash Flow Formula Step By Step Calculation With Examples

Question Gopal Does Not Keep Proper Records In The Books Of Account Following Information Is Given Below Itemsjan 1 2005dec 31 2005cash In Hand 18 000 12 000 Cash At Bank 1 500 2 000 Stock

How To Calculate Net Cash Flow In Excel 3 Suitable Examples

Solved Calculate Cash Flow To Creditor And Cash Flow Chegg Com

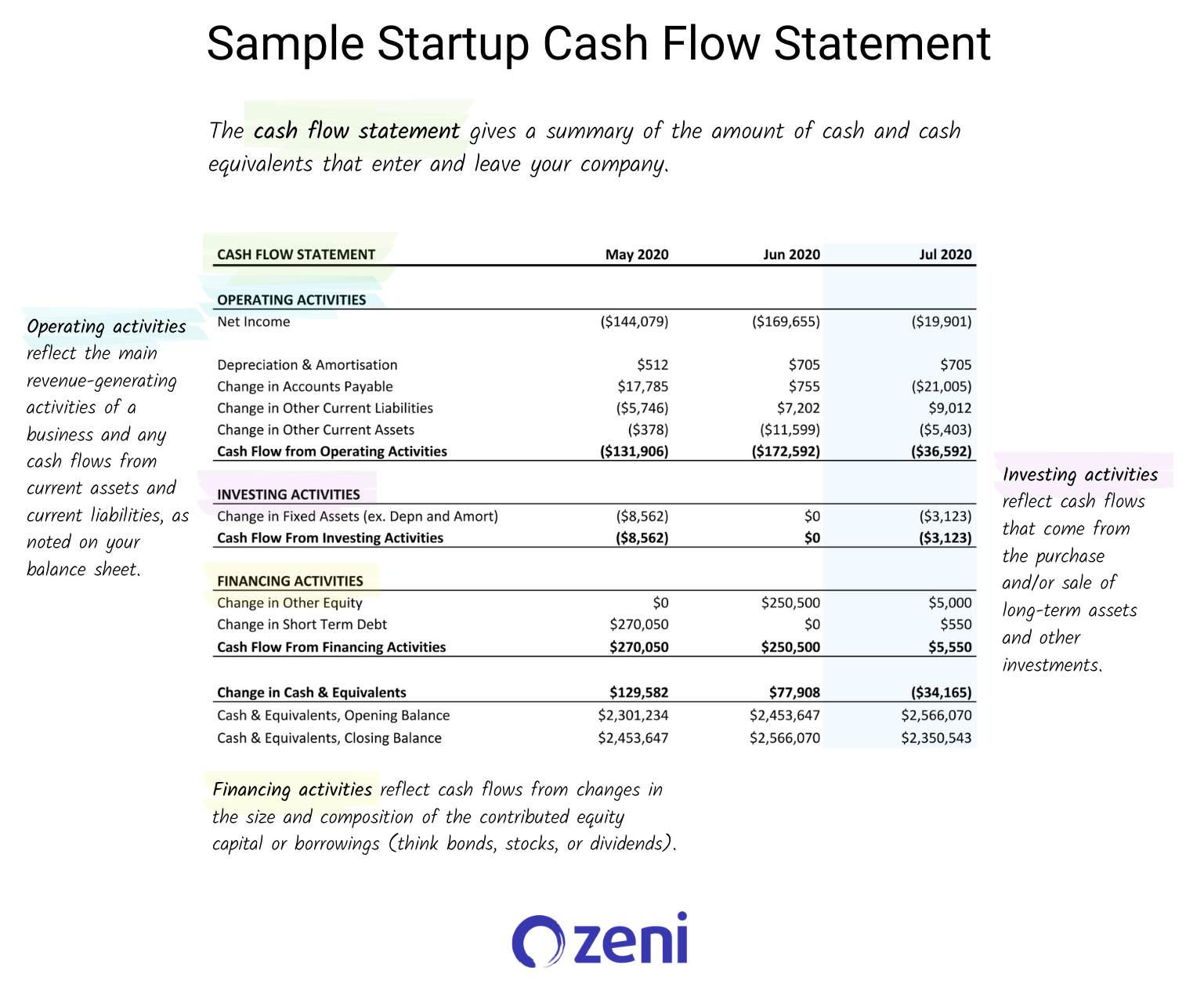

How To Read A Cash Flow Statement Zeni

How To Calculate Cash Flow 15 Steps With Pictures Wikihow

:max_bytes(150000):strip_icc()/dotdash_Final_Corporate_Cash_Flow_Understanding_the_Essentials_Oct_2020-01-3c5fb3c82fb240c0bad19e14f04ce874.jpg)

Corporate Cash Flow Understanding The Essentials

Operating Cash Flow Basics Smartsheet

Cash Flow Coverage Ratio Calculator Efinancemanagement

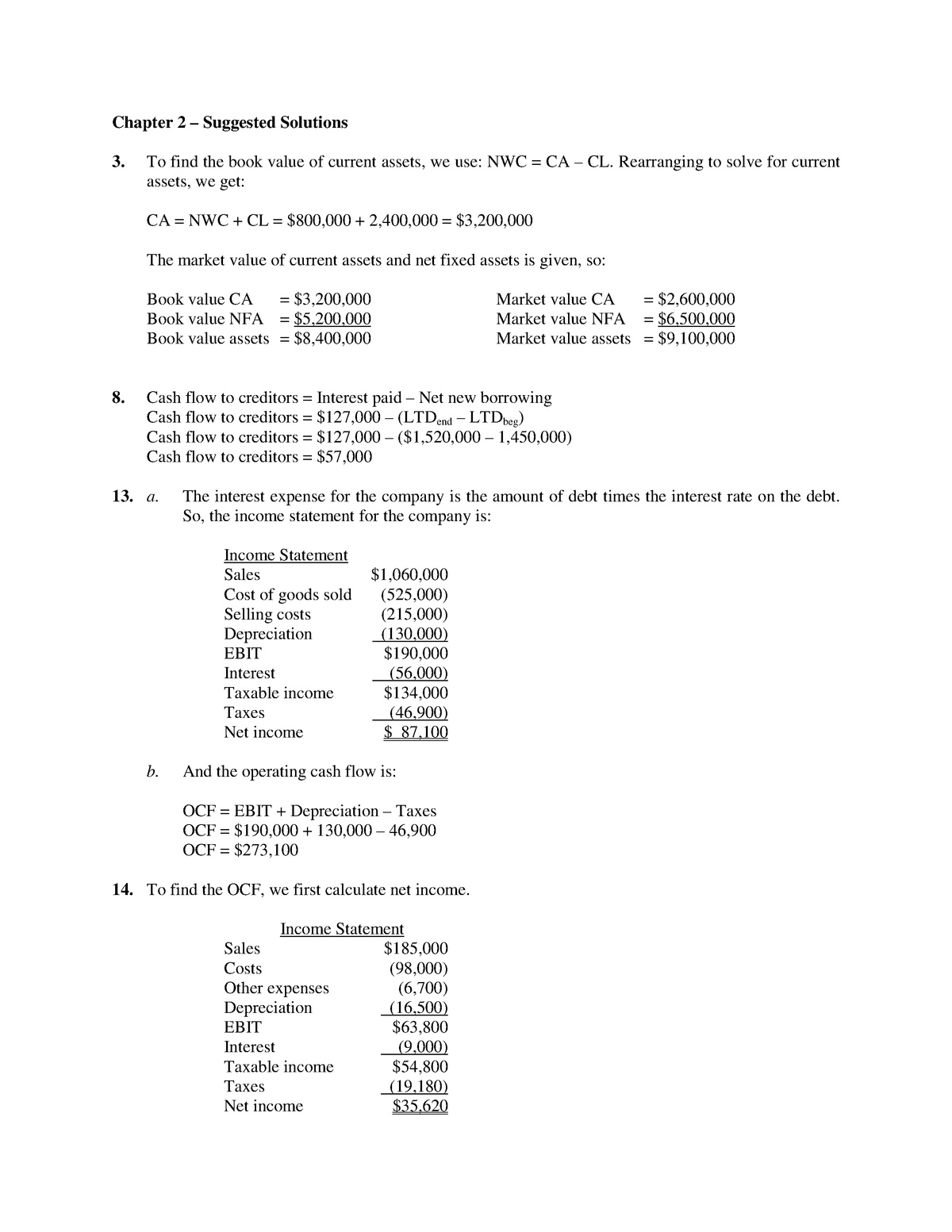

Tutorial 2 Chapter 2 Suggested Solutions 3 To Find The Book Value Of Current Assets We Use Studocu

Solved Problem 2 22 Calculating Cash Flow L04 Use The Chegg Com

Calculate Cash Flow Creditors Ppt Powerpoint Presentation Infographics Graphic Cpb Presentation Graphics Presentation Powerpoint Example Slide Templates

Training Modular Financial Modeling Annual Forecast Model Debtors Creditors Creditors Modano

Here S How To Read A Cash Flow Statement Hourly Inc

How To Calculate Cash Flow 15 Steps With Pictures Wikihow

Cash Flow Formula How To Calculate Cash Flow With Examples

Solved Use The Following Information For Taco Swell Inc Chegg Com